Where Do My Fees Go?

Today we’re going to talk about all the clients that come to me who want to understand what’s going on in the world of credit card processing. They want to know how to keep their rates low and not get screwed. In order to do that, you need to know who’s getting paid how much and where the money goes.

Once you know all that you’re equipped to not get taken advantage of with a credit card processor…well, almost.

When you get your monthly statement, there are three entities who are getting paid processing fees on that statement.

- Banks

- Brands

- Processor

When we talk about banks, most people refer to them as the credit card company. Which may be the case but more specific it’s the banks that issue – credit and debit cards to our customers -like your Chase, Capital One, Wells Fargo, Citi, Credit union, etc. (Check this article for differentiation of banks *coming soon*)

Then you have your brands primarily Visa & MasterCard. We don’t include Discover and Amex because in these cases Discover and Amex act as banks and brands

Then you have the processor and we underwrite you, the merchant.

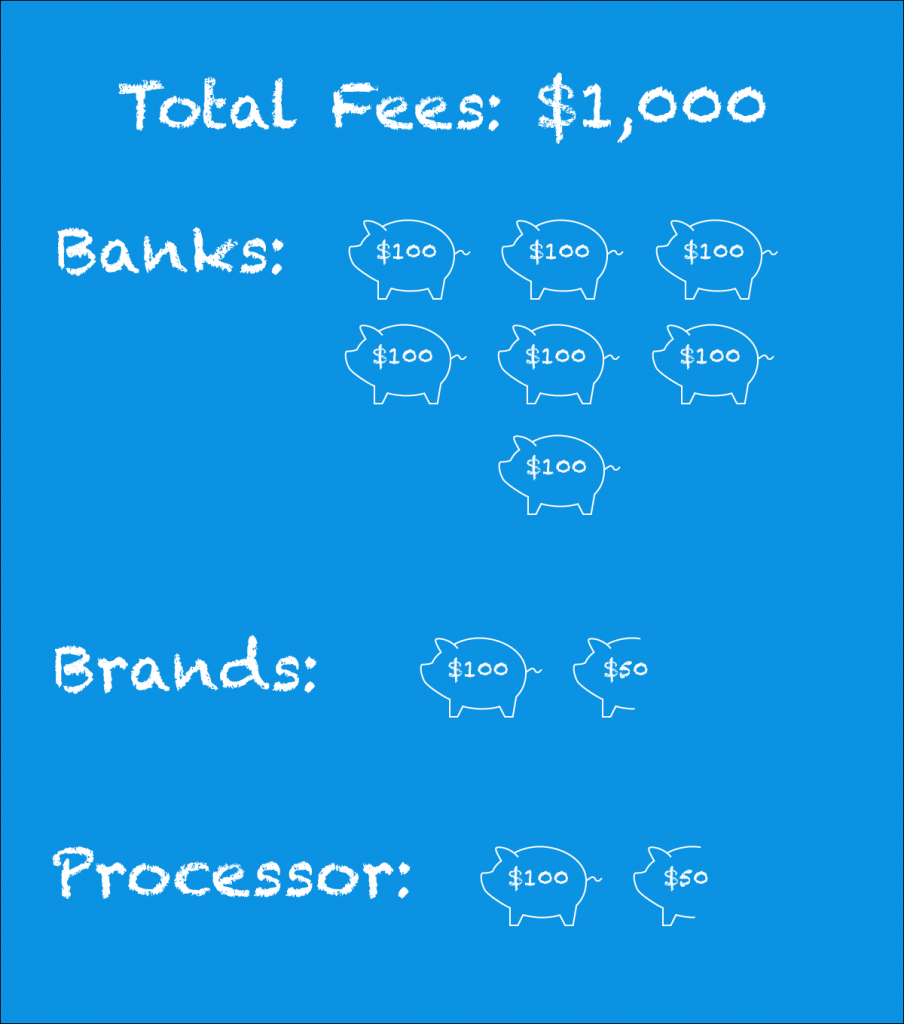

So the other day a client asked me, “Hey, we give you $1,000 every month. How much of that do you get?” and this is what I told them.

Out of that thousand dollars that shows up on your processing statement, this is roughly where it goes:

Out of that thousand dollars that shows up on your processing statement, this is roughly where it goes:

- $700 of it goes to the bank that issued those debit and credit cards to your clients who are spending money with you.

- $150 goes to Visa & MasterCard, and

- $150goes to the processor, like Basis Point

We underwrite you. Whereas the bank is underwriting your clients. We get $150 but what we do on your behalf is we take that thousand dollars from you and we distribute it to the bank, to Visa, MasterCard, and then our charge covers our cost and profit.

I have never talked to a business owner that didn’t want to reduce their expenses or was totally happy with a processor…unless they are already with Basis Point. Now, as I say that we’re not for everyone. There are – customers that we say we’re not the best fit for and will recommend them to another processor or agency that will be a better fit.

In this case, this business was paying about $1000 a month in total processing fees. I simply showed the business owner just like the hundreds of other clients I have where the money went, who was getting what, how much my minimum was, and how that saved him money.

Everyone is getting hit with promises that by switching processors they are going to save thousands a month. The only negotiable portion of a bill is the processor fees which you can see in this case is only 15% of the total bill. If this client was able to find a processor willing to lose money and process the transactions at no cost the total savings is $150 per month. Your questions become how much will they save you of that $150? Am I getting a better value or am I losing value? Do they have a financial anchor? Is there a contract with a penalty to exit? Is there a remedy if the promised savings aren’t delivered or am I stuck?

That other $850 is there no matter who sends your statement.